Figuring out how much to save based on when you plan to retire can be tricky. A question you might ask yourself is, “Will I need to sacrifice my quality of life in order to retire early?” One of the best ways to find the answer is to understand how much you need to save to continue your spending habits.

A successful way to plan your early retirement is through the use of Silvur’s Retirement Score. Our Retirement Score shows you how long your savings are projected to last based on how much you’ve saved, along with other factors like when you plan to retire and at what age you’ll begin taking Social Security benefits. Below, we’ll go through an example on how budgeting and spending can put a dent in your savings if you don’t plan accurately.

Example

In this example, Ellen has saved $500,000 and intends to live on a budget of $3,000 per month in retirement. She is currently making $60,000 along with her husband, Bob. Ellen and Bob are the same age, they plan to retire by age 57 and elect their Social Security benefits at age 65.

Based on their $500,000 in retirement savings, they can afford to spend $3,000 a month to make sure their savings last longer than their lifetime with a Retirement Score of 98 years and 8 months.

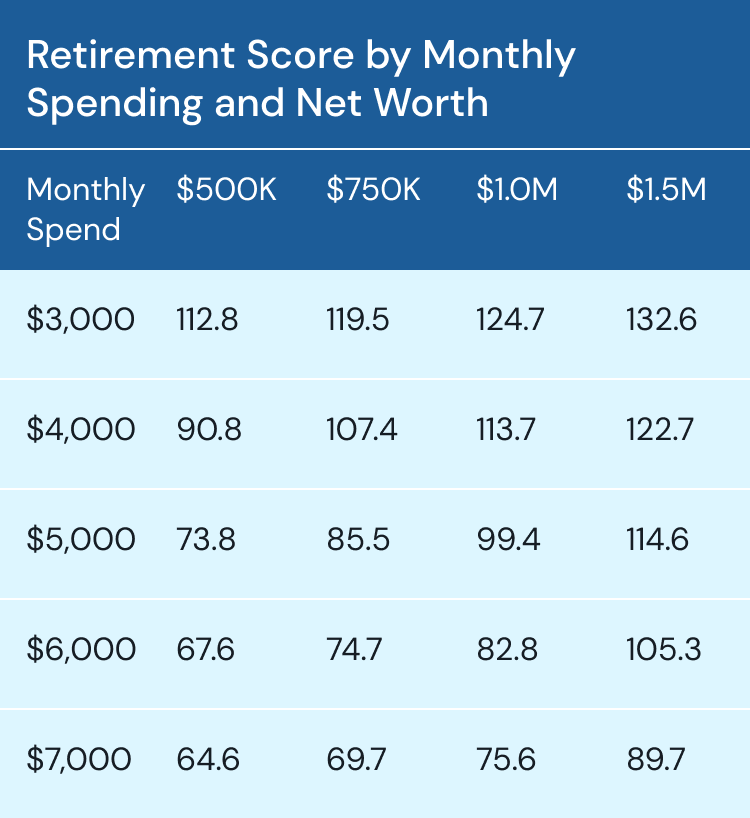

However, if Ellen and Bob spent lavishly at $7,000 a month, they would burn through their savings by age 65. At that spending level, there’s a chance that not even a $1,500,000 nest egg would last, with our Retirement Score showing the money running out before age 90.

Now, let’s suppose Ellen and Bob have saved $1,500,000 for retirement. By sticking to a budget of $3,000 per month, their money would last through the entirety of their retirement and then some; they’d be able to pass money down to future generations according to their Retirement Score of 132.6. And if leaving an inheritance isn’t a priority, Ellen and Bob could live a bit more lavishly, spending up to $6,000 per month without much likelihood of running out of money (according to their Retirement Score of 105.3).

Note: We assume that the Retirement Score is calculated at age 55, retire at age 57, and elect Social Security at 65. Net worth is assumed split between savings and IRA accounts.

What You Can Do Now

Wondering where you stand? Start by getting your custom Retirement Score.

- In Silvur, set your retirement age to the age you’d like to retire to see how that changes your Retirement Score.

- Review your elections, retirement accounts, and expenses to determine your Silvur Retirement Score. That will give you a more accurate sense of whether you have saved enough to retire.