Last Updated: December 30, 2025

How much money you’ll need is the greatest enigma about retirement, and something that’s at the forefront of everyone’s mind. But if your spending outweighs your retirement savings, you may run out of money in retirement - something Silvur wants you to avoid. By carefully planning your retirement strategy, you can retire in your early 60s as long as you stick to your spending budget.

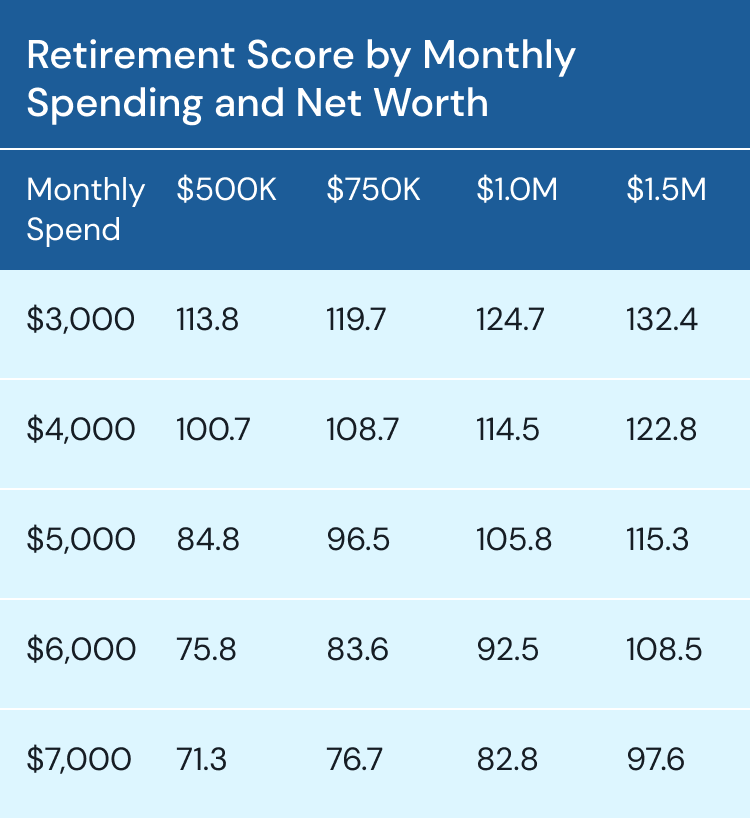

While there’s no magic number that works for everyone when it comes to retirement, it’s helpful to plug your savings and investment information into the Silvur app to get your customized Retirement Score. This is a calculation that takes into account how much money you’ve saved, along with factors like your age, when you hope to retire and when you’re planning on drawing Social Security benefits (if you’re eligible). Below is an example of what you can learn from Silvur’s Retirement Score about your likelihood of having enough money to retire with.

Example

Remember Bob and Ellen from our 50-59 class? In this example they’ve decided to wait until their early sixties to retire. Now, they both plan to retire at 60, and they’ll be drawing Social Security starting at age 62. Together, they’ve saved $500,000 in retirement accounts. But since they’ll be retiring at 60, they’ll be able to spend a little bit more compared to their counterparts who retired in their fifties.

Based on their $500,000 net worth, they’ll be able to spend $4,000 a month while maintaining a Retirement Score of 100 years an 8 months--making their savings likely to last beyond their years.

But if Bob and Ellen spent $5,000 a month, their Retirement Score will dramatically decrease to 84 years and 9 months. The $1,000 difference a month equates to an additional 16 years in savings.

Let’s suppose Ellen and Bob built their net worth to $1,500,000, they will be able to spend up to $7,000 a month. Their Retirement Score will be beyond 97 years allowing them to pass an inheritance.

Below, you’ll see that with their Social Security income and their savings, Bob and Ellen should be able to outlive their money as long as they spend wisely and don’t allow their monthly spending to go above $4,000 if their net worth was $500,000 and more.

Note: We assume that the Retirement Score is calculated at age 55, retire at age 60, and elect Social Security at 64. Net worth is assumed split between savings and IRA accounts.

What You Can Do Now

If you’re looking to retire anywhere between 60 to 64, plug your basic information into Silvur to obtain a Retirement Score. This will give you a good idea how long your savings will last in retirement, and whether you’re on par to retire in your early to mid-sixties.